Guide to the Perplexed

Atlas F1 Writers

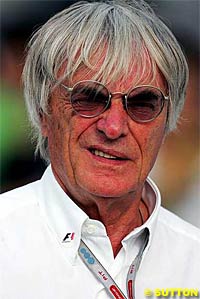

The headlines promise the most important battle over the future of Formula One. The analysts count the punches on either side. Most fans, however, remain confused and unaware just what the case of Speed Investments Ltd ('The Banks') versus Bambino Holdings ('Bernie') is all about. Thomas O'Keefe and Dieter Rencken offer insight into the recent legal proceedings of the case, and explain why this isn't quite the beginning of the end of Ecclestone's reign... Includes the full judgement of the Court of Appeal!

"EM.TV have a 50 percent share, but no control. No control whatever. [EM.TV's head, Thomas Haffa] could sell his shares to whoever he wanted, and it wouldn't make any difference because they wouldn't have any control. Their 50 percent is like having 5 percent. The control rests with the trust, and I am still the chief executive of the company that the trust own."

If representatives of Bayerische Landesbank, JP Morgan and Lehman Brothers had read the interview with Bernie Ecclestone in the October 2000 edition of F1 Racing, where the Formula One supremo revealed the above, they may not have found themselves today in a legal battle that could see them left with nothing.

But, as always in Formula One, matters are not as simple as they seem. Plus, as Sir Frank Williams said so presciently shortly before judgement was handed down in the 'Buttongate' affair: "When you subject yourself to litigation, you must be prepared to lose as easily as win..."

And, so it will be in the matter between Speed Investments Ltd, the company made up of the three banks contesting the matter, and Formula One Holdings – in which the Ecclestone family trust holds 25% via its Bambino Holdings. FOH in turn is totally owned by SLEC, of which more anon.

In early 2000, Ecclestone, who had formed SLEC in the wake of his being granted, from 1998, the 10-year rights to all Formula One's commercial matters, concluded a deal with Thomas Haffa whereby two lots of 25% of SLEC were transferred to the German's marketing and licensing company, EM.TV and Merchandising, in exchange for $1.2 billion (USD).

Haffa, who had initially made his fortune through the marketing of Munich's Oktoberfest and the subsequent acquisition of the rights to The Muppets and sundry fictional characters, was content to let Ecclestone run Formula One whilst wanting only control of the sport's merchandising rights. Written into the deal was a 'call option', whereby EM.TV could exercise the rights to a third block of 25% of SLEC (for $400 million), thereby owning a total of 75% of Formula One via three minority bundles, each equalling 25%, but without management control. In real terms, therefore, EM.TV owned not 75%, but three smaller blocks of 25% which were not cumulative. The precedent was, at that early stage, set...

No sooner done, than EM.TV hemorrhaged cash and the Munich-based merchandising company's share price plummeted from $115 to under $5 in less than 12 months. Various charges were brought against Haffa and younger brother Florian, after projected earnings were many times overstated, and the brothers were criminally fined for breaches of German company laws.

Before EM.TV collapsed, the elder Haffa turned to former mentor Leo Kirch, he of the eponymous media company, for salvation. The Bavarian had amassed a fortune through ownership of thousands of Hollywood's celluloid blockbusters, and had founded Premiere, Germany's largest pay-per-view television station. Kirch Media owned the PPV rights to German football and other sports, and Formula One would be, he reckoned, the jewel in his media crown.

It all fitted: Michael Schumacher was the darling of Germany, the country had four drivers on the grid, Mercedes had won two World Championship titles on the trot, BMW had recently re-entered the sport, and Ecclestone had, a short while before, launched Formula One's digital PPV masterpiece at enormous cost.

To prevent EM.TV's assets (and its 25% 'call option') passing him by, Kirch urgently needed to borrow funds. First he turned to his local bank (the Bayerische Landesbank), who supplied a portion, then to JP Morgan and Lehman Bros, who brokered the deal. Hastiness dictated that $1.6 billion was loaned seemingly without due and proper diligence, and the management control clauses and implications of three individual share blocks of 25% (as opposed to one block of 75%), thus, went undetected.

The banks, however, held the shares as security, and thought no more of it, until Kirch hit his first major obstacle – PPV failed to take off generally, and not in Formula One specifically. 'Bernievision' was, despite superb quality, an abject failure, but even before the market voted with its free-to-air receivers, another obstacle reared its head: consumer advertisers, who had entered into Formula One sponsorship deals in the belief that free-to-air television would be available across the globe, threatened to boycott all Kirch's media outlets if he went ahead with PPV. Kirch sank, and three banks became, extremely unwillingly, the owners of 75% of Formula One.

They regrouped, formed Speed Investments Ltd, and attempted to claim 75% of SLEC's board appointments. Only then was the discovery made that no such rights exist; worse, upon reading the fine print, they realised that SLEC's Formula One franchise – the duration of which had in the mean time increased ten-fold to 100 years in order to satisfy a settlement with the European Union – could be terminated by the FIA should there be a significant change of control.

The banks accepted their bundle, for, after all, they knew (and, four years on, still know) nothing about the business of Formula One, and hoped against hope that SLEC would turn sufficient profits to pay decent dividends on $1.6 billion. Worse, though, was the question of who could/would take the poisoned chalice off them. Ecclestone offered exactly one-quarter of the amount originally given Kirch for the three share blocks but, unwilling to write down upwards of a billion, the offer was refused.

This coincided with increased activity by the GPWC. The body had been founded in mid-2001 by the European motor manufacturers competing in Formula One - BMW, Fiat/Ferrari, Ford/Jaguar, Mercedes-Benz and Renault - after they had become increasingly dissatisfied with the lack of transparency displayed by Ecclestone and frustrated with seeing only 23% of F1's revenues distributed to the ten competing teams whilst three banks and a former model trousered the balance.

GPWC's aim and modus operandi has been to pressurise SLEC into parting with greater shares of Formula One's considerable revenues by threatening the formation of a breakaway Championship, one run by GPWC appointees for GPWC members. The threat to the banks was more than thinly veiled: as Ferrari president Luca di Montezemolo said, in an interview with The Sunday Times in 2003: "As a manager, [Bernie] got more than the teams because he was good, but now the car manufacturers are not prepared to fund the banks, they prefer to have it in their own pockets. Without us in 2008, the banks will own 100% of nothing."

With GPWC now the bank's only hope of recovering their money, and after a failed attempt to broker a deal a year ago, the three financial institutions decided to claim the control they felt they rightfully deserve as owners of 75% of SLEC.

Shortly before, Ecclestone, through Bambino Holdings' 25% share in SLEC, appointed long-time associates Luc Argand and Emmanuele Argand-Rey, a Swiss-based husband-and-wife legal team, to the board of SLEC-owned subsidiary Formula One Holdings. Speed Investments questioned these appointments, only to be reminded that the shareholding agreement they inherited in fact grants Ecclestone the right to appoint these two additional directors.

Thus, Speed Investments instituted legal proceedings in Britain earlier this year, and, in July Formula One Holdings disputed the jurisdiction of British courts in the matter, maintaining that the Swiss system should hear the matter as the Argand-Reys were appointed in Switzerland and were Swiss. Mr Justice Lewison, though, found that the matter fell within the realm of British law, and ruled accordingly.

Bambino Holdings appealed the verdict, but three appeal judges - Lord Justice Carnwath, Lord Justice Neuberger and Sir William Aldous - agreed with Lewison (see the verdict below). They additionally found that the matter was 'not just about SLEC's board appointments, but who controls Formula One, and that no purpose would be served by further delaying the hearing'. A date of 22/23 November was set down in London.

Elizabeth Jones QC, for Speed Investments Ltd, opened by requesting immediate summary judgement on the basis that Formula One Holdings' defence of its actions and appointments were untenable. Formula One Holdings chose to not even defend the matter – which, in view of Ecclestone's reputation as a fighter and his previous indication that any verdict would be abided by, speaks volumes for his legal team's confidence in their case.

That Mr Justice Park did not deliver summary judgement is significant: it would appear that, hidden deep within the submissions, are suggestions that Speed Investments holds not 75% of SLEC, but three individual blocks of 25% each. So, 3 x 25% may equal just 25%, meaning that Speed Investments and Bambino Holdings - with its 25% - are equal partners, with equal say in matters SLEC and Formula One Holdings. In that case, Speed Investments Ltd would have the right to make an equal number of appointments, but the deadlock would continue.

When reading the opinion of the Court of Appeal, it is the opening line of the opinion that catches your attention: "The overall dispute concerns the control and future of Formula One racing." But from that dramatic opening, the court goes on to minimize the actual legal issue before the court - which was a narrow, technical, jurisdictional point: what law would apply to the dispute, English or Swiss. England won.

How did that jurisdictional issue come up? Because the two Swiss directors, which Bambino Holdings appointed to FOH, immediately filed suit in Geneva once they knew Speed Investments Ltd would be suing them in England. So there was, in effect, a race to the courthouse, appropriate for a motor racing case...

Now that the Court of Appeal's decision has been rendered, the action switches back from the appellate court down to the trial court, where the current summary judgment motion - brought on by Speed Investments Ltd - has been argued but reportedly will not be decided for a couple of weeks.

Summary Judgment sounds great but is not so easy to obtain as long as the opposing party (here, Ecclestone and FOH) can show that there are material facts in dispute. Some reporters seems to think that just because Speed Investments's QC brings a summary judgment motion on, there must be good grounds for it and a reasonable chance of success. Not so.

In fact, a party must meet a very high standard to win on a summary judgment motion and there were hints in the opinion (as appears in full below) that the Court of Appeal was handing this round of the match to Speed Investments but might not be entirely convinced as to the merits of Speed's ultimate case. It is conceivable, then - in fact more than likely - that the banks may have won this battle but could lose the war.

The issue for the lower court on summary judgment is this: can it be said that there are no material facts in dispute, such that the issue at hand is purely a question of law for a court to decide? Were the Swiss directors, appointed by Bambino Holdings, properly appointed or not under the governing documents of the entity they were appointed to, Formula One Holdings Limited? This includes articles of association, as well as the extremely important and interesting SLEC Shareholders Agreement, entered into by Speed with Ecclestone/FOH on May 12th 2000.

The significance of the Court of Appeal's decision was only that it has now been decided that English law will govern in answering that question - not Swiss law or Jersey law, the other possible jurisdictions.

Furthermore, the court's decision is not earth-shaking but merely a technical, jurisdictional matter where the correct conclusion was reached: technical issues as to FOH's corporate documents and the composition of FOH's board of directors ought to be decided by the jurisdiction where the entity was formed and is registered, in this case England and Wales. So it is true to say that this was a preliminary skirmish and not Armageddon for F1.

Importantly, the SLEC Shareholders Agreement referred to in the opinion established a crazy composition of the FOH Board of Directors, providing for a maximum of 8 directors, evenly split between the two parties, Speed Investments Ltd (the banks) and Bambino Holdings (Ecclestone).

This set-up was a recipe for disaster that was bound to fail as to smooth corporate governance, but it is certainly not illegal. When one sets up a company, one typically provides for an odd number of directors since otherwise deadlock and stalemate, which hamper decision making, rule the day.

Obviously, that kind of paralysis favored Ecclestone, but it has to be remembered that when the SLEC Shareholders Agreement was entered into by Speed, it was when everyone was on the same side and before Speed defaulted on its loans with the banks, thus explaining how Ecclestone managed to obtain rough equivalence with Speed when it came to appointing directors to FOH although Bernie had sold 75% of his stock to Speed once all the options had been exercised. But the banks are stuck in 2004 with what Speed's principals negotiated in 2000.

So the question is, really, are there material facts in dispute? Contrary to common belief, Bernie Ecclestone does not have much reason to be worried by this legal case as these material facts are all FOH will have to show in order to defeat Speed's summary judgment motion. This in turn would force the matter to a time-consuming, full-blown trial, with discovery and sessions before a jury - by which time, as Luca di Montezemolo warned, the banks may well find out they own 100% of nothing.

Case No: A3/2004/1684

[2004] EWHC 1827 (Ch)

Royal Courts of Justice

LORD JUSTICE CARNWATH

LORD JUSTICE NEUBERGER

SIR WILLIAM ALDOUS

- - - - - - - - - - - - - - - - - - - - -

Between:

- - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - -

Elizabeth Jones QC and Nicholas Harrison (instructed by White and Case)

Murray Rosen QC and Nick Parfitt (instructed by Lovells)

Hearing date: 20th October 2004

- - - - - - - - - - - - - - - - - - - - -

Judgment Approved by the court

Lord Justice Carnwath:

Background

(B) The holders of a majority in nominal value of the B shares should be permitted to appoint two directors of each of the subsidiaries, the ("B subsidiary directors"); and.

(C) The subsidiary directors are sent at the same time as the other directors of the relevant subsidiary notice of any meeting of the directors of such subsidiary and a copy of all papers sent to such directors."

Competing jurisdictions

9. FOH is a company registered in England and Wales. The two claimants, Speed and SLEC are both Jersey companies. Bambino, the second defendant, is another Jersey company. The Argands are individuals domiciled in Switzerland. Jersey is not a part of the United Kingdom, either for the purpose of the Judgments Regulation or for the purposes of the Lugano Convention. Switzerland is not a member state of the European Union, but it is a contracting state for the purposes of the Lugano Convention.

"2. In proceedings which have as their object the validity of the constitution, the nullity or the dissolution of companies or other legal persons or associations of natural or legal persons, or of the validity of the decisions of their organs, the courts of the member state in which the company, legal person or association has its seat. In order to determine that seat, the court shall apply its rules of private international law.

"3. In proceedings which have as their object the validity of entries in public registers, the courts of the member state in which the register is kept." (emphasis added)

and Article 28, which provides that "a judgment shall not be recognised" if it conflicts with (among others) Section 5 of that Convention (which includes Article 16).

Particulars of claim

33. Bambino was not entitled to appoint Monsieur Argand and Madame Argand-Rey as B-directors of FOH because Bambino had already exhausted its rights to appoint B-directors under the new FOH articles. Alternatively, Bambino is estopped from denying that it had already exhausted its right to appoint B-directors under the new FOH articles. The claimants will say as follows:

33.1. In connection with the purchase of Speed by EM.TV and the acquisition of shares in SLEC by Speed in accordance with the master agreement, the directors of FOH appointed prior to 12th May 2000 were agreed by SLEC, FOH, Bambino and Speed to be designated A-directors and B-directors respectively in accordance with the new FOH articles adopted on the same day, as evidenced by the description of such persons as A-directors and B-directors in schedule 1, part 2 of the SLEC Shareholders Agreement.

33.2. Further or alternatively, by including schedule 1, part 2 of the SLEC Shareholders Agreement, each of the parties to the SLEC Shareholders Agreement represented to the others that they would treat the persons set out in the said schedule as A and B-directors respectively as having been appointed A and B-directors in accordance with the new FOH articles.

33.3. Further or alternatively, by the SLEC Shareholders Agreement, Bambino contracted with Speed, SLEC and FOH that the persons described as B-directors of FOH in schedule 1, part 2 of the SLEC Shareholders Agreement should be deemed to be appointed as such B-directors of FOH in accordance with the new FOH articles. The claimants will refer to clause 4 (A) of the SLEC Shareholders Agreement.

33.4. Further or alternatively, SLEC and Bambino have thereafter conducted themselves on the basis that and in reliance on the representation pleaded in paragraph 33.2 above, that the persons set out in schedule 1, part 2 of the SLEC Shareholders Agreement as A and B-directors respectively were appointed as A-directors by Speed and as B-directors by Bambino respectively. Paragraph 27 above is repeated.

34. In the premises, Monsieur Argand and Madame Argand-Rey have not been appointed as directors of FOH

...

37. On 11th November 2002, SLEC as sole shareholder in FOH appointed Mr Diederichs and Mr Mann as directors of FOH, not being A-directors or B-directors. Bambino and the secretary of FOH have refused to recognise the appointment of Mr Diederichs and Mr Mann on the basis that there were no vacancies of the board of directors because Bambino and the secretary of FOH contend that Monsieur Argand and Madame Argand-Rey were validly appointed.

...

41. A dispute has arisen between FOH, SLEC, Speed and Bambino as to who are the directors of FOH. The register of directors maintained by FOH pursuant to Section 288 of the Companies Act 1985 records Monsieur Argand and Madame Argand-Rey as directors of FOH and does not record Mr Diederichs and Mr Mann as directors of FOH. The entry of the names of Monsieur Argand and Madame Argand-Rey in the said register is invalid and FOH is obliged to include particulars of Mr Diederichs and Mr Mann in the said register.

42. The accounts of FOH for the year ended 31st December 2002 were due to be filed at Companies House by 31st October 2003. By reason of the dispute between FOH, SLEC, Speed and Bambino as to the identity of the directors of FOH, substantial difficulties were encountered in approving and filing the said accounts. It was not possible to call a meeting of the board of directors because of the dispute as to who had been validly appointed directors of FOH."

2. A claim for rectification of invalid entries in the register of directors of the first defendant.

3. A claim for a declaration as to the validity of a written resolution of the board of directors of the first defendant."

Exclusive jurisdiction

The appellants submit that Article 16(2) governs all questions which are concerned with the internal management of the company and that this extends to all disputes which arise out of the relationship between a company and its officers or shareholders or between its shareholders and officers, possibly even between its shareholders inter se. This submission is far too wide. Whether an action falls within Article 16(2) depends upon its subject matter - the nature of the dispute - not upon the relationship between the parties. A claim by an officer of a company for wrongful dismissal, for example, does not fall within the Article, although a claim that the decision to dismiss him had been taken by a meeting of the board which was inquorate would do so." (emphasis added)

On the facts of that case, it was held that the subject matter of the dispute (which was an alleged fraud practised by the defendants) fell outside Article 16(2).

The supporting text (under the heading "Internal management") states:

(emphasis added; the footnote cites Sierra Leone Telecommunications Ltd v Barclays Bank plc [1998] 2 All ER 821.)

That sentence encapsulates the issue in this case.

Consistency will be achieved if the same court has jurisdiction to decide on the validity of both past and future decisions.

As I have said, the judge’s approach is fully justified by the objectives of the article as explained by Stuart-Smith LJ, and is consistent with the reasonable expectations of those involved.

He approved, but distinguished, the decision of Rattee J, in Re Hayward, decd [1997] Ch 45. In that case, a bankrupt’s wife had purported to transfer his interest in a Minorca property to a creditor; the trustee was seeking an order that it formed part of the bankrupt’s estate, and for consequent rectification of the Minorca property register. It was held that this was outside the jurisdiction of the English court, because the principal subject-matter of the proceedings was the ownership of the Minorca property.

The "stay" issue

"where the second seised court has exclusive jurisdiction under Article 16 and the first seised court non-exclusive jurisdiction, then according to the spirit and policy of the Convention, Article 21 is inapplicable in the second seised court and the latter need not therefore decline to adjudicate."

The main reason he gives is that –

"the first seised court's judgment will not be entitled to recognition in other contracting states... and consequently, community-wide recognition will not be required to be given to two possibly conflicting judgments..."

"... Article 21 should be inapplicable where the court seised second has exclusive jurisdiction under Article 16, for a judgment given by the court seised first in violation of Article 16 will be refused recognition in all contracting states and there is no sensible purpose in deferring to a court whose judgment will be a nullity in England..."

"If a court gives judgment in violation of article 23, its judgment must not be recognised.... It appears to follow that the court with article 23 jurisdiction should proceed to hear the case, for otherwise there will be no judgment on the merits capable of being recognised in other member states."

First seised

Conclusion

Lord Justice Neuberger

Sir William Aldous

The Background - by Dieter Rencken

Seemingly, the case of 'The Banks versus Bernie' - as the matter has become known - should be a simple legal matter for Mr Justice Park to preside over. On the one hand, he has a party which holds 75% of an entity's equity, but with no proportionate voting power in the company's management; on the other hand, he has a family trust which dominates proceedings through just a quarter of the shareholding.

Seemingly, the case of 'The Banks versus Bernie' - as the matter has become known - should be a simple legal matter for Mr Justice Park to preside over. On the one hand, he has a party which holds 75% of an entity's equity, but with no proportionate voting power in the company's management; on the other hand, he has a family trust which dominates proceedings through just a quarter of the shareholding.

The Legal Analysis - by Thomas O'Keefe

The Court of Appeal's Full Decision

COURT OF APPEAL (CIVIL DIVISION)

ON APPEAL FROM CHANCERY DIVISION

MR JUSTICE LEWISON

Strand,

London,

WC2A 2LL

Date: Friday 12th November 2004

and

1. SPEED INVESTMENTS LIMITED Claimants/ s 2. SLEC HOLDINGS LMITED - and - 1. FORMULA ONE HOLDINGS LIMITED Defendants/ s 2. BAMBINO HOLDINGS LIMITED 3. LUC ARGAND 4. EMMANUELE ARGAND-REY

for the Claimants/Respondents

for the Defendants/Appellants

for handing down

(subject to editorial corrections)"(A) The holders of a majority in nominal value of the A shares should be permitted to appoint a director to each of the subsidiaries, the ("A subsidiary directors");

"The following court shall have exclusive jurisdiction regardless of domicile.

"Where proceedings involving the same cause of action and between the same parties are brought in the courts of different contracting states, any court other than the court first seised shall of its own notion stay its proceedings until such time as the jurisdiction of the court first seised is established. Where the jurisdiction of the court first seised is established, any court other than the court first seised shall decline jurisdiction in favour of that court." (emphasis added)

"Where actions come within the exclusive jurisdiction of several courts, any court other than the court first seised shall decline jurisdiction in favour of that court"

"32. On 7th October 2002, Bambino purported to appoint Monsieur Argand and Madame Argand-Rey as B-directors of FOH pursuant to Article 14 (A) of the new FOH articles.

"1. A claim for declarations as to the identity of the directors of the first defendant.

"In my judgment, the subject matter of the English proceedings is the composition of the board of directors of Formula One Holdings and therefore it does fall within Article 22(2). The claim to rectify the register of directors, in my judgment, falls within Article 22(3)." (para 38)

"The paragraphs of Article 16 constitute a series of exceptions to the basic jurisdictional rules established by the Convention. The objective of Article 16(2) is to confer exclusive jurisdiction to decide questions concerning the constitution and internal management of a company on the courts of a contracting state in which the company has its seat. It is generally accepted as a matter of private international law that the law of the place of incorporation determines the capacity of the company, the composition and powers of the various organs of the company, the formalities and procedures laid down for them, the extent of an individual member's liability for the debts and liabilities of the company, and other matters of that kind. The objective of Article 16(2) is to confer exclusive jurisdiction to determine all such questions on the courts of the state where the company has its seat. The other paragraphs of the Article follow a similar logic.

"Rule 154(2) All matters concerning the constitution of a corporation are governed by the law of the place of incorporation."

"The cases at least establish that the law of the place of incorporation determines whether directors have been validly appointed..."

"Article 16(2) provides that the courts of the state in which a company or other legal person, or an association of natural or legal persons, has its seat, have exclusive jurisdiction in proceedings which are in substance concerned either with the validity of the constitution, the nullity or the dissolution of the company, legal person or association, or with the decisions of its organs. It is important, in the interests of legal certainty, to avoid conflicting judgments being given as regards the existence of a company or association or as regards the validity of the decisions of its organs. For this reason, it is obviously preferable that all proceedings should take place in the courts of the state in which the company or association has its seat." (para A1.158, emphasis added)

"Secondly, as the court has already held, article 16 must not be given a wider interpretation than is required by its objective, since it results in depriving the parties of the choice of forum which would otherwise be theirs and, in certain cases, results in their being brought before a court which is not that of any of them..."

"The trustee... is not seeking to establish or protect, let alone, perfect, his title to Mr Pollard’s interest in the Portuguese property." (para 60)

I agree.

I also agree.

| Contact the Editor |

Please Contact Us for permission to republish this or any other material from Atlas F1.

|

Volume 10, Issue 47

Interview with Pierre Dupasquier (II)

The Banks Vs. Bernie

Bookworm Critique

On the Road

Elsewhere in Racing

The Weekly Grapevine

> Homepage |